I’ll save you the suspense: MCD’s stock price returns were affected by the release of Morgan Spurlock’s Supersize Me on May 7, 2004. However, MCD’s stock price returns were also unaffected by the release of Morgan Spurlock’s Supersize Me when measured differently.

If you just change how you measure the reaction, you can get the data to tell you what you want. In the business it’s called confirmation bias or data mining. The desire to produce a positive result incentivizes researchers to get the numbers to tell them what they want to hear.

In the example of McDonald’s stock price, we use an event study to gauge the average change in stock price before and after the ‘event’. Morgan Spurlock’s Supersize Me didn’t portray McDonald’s fares in the most appealing light, so I expected to find a negative change in the returns and volume of McDonalds stock, all else held constant.

Quick stats refresher: A big t-stat implies rejection of the null hypothesis, in favor of the tested hypothesis. A small p-value implies significance. A p-value ranges from [0,1] with zero being the most significant and one being the least.

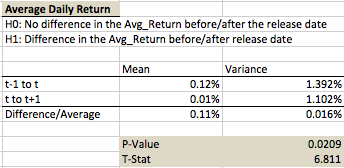

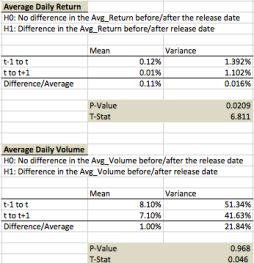

Using a simple t-test to compare average daily returns here’s my results:

A small p-value, as we see above, implies significance. This means the average return on MCD’s stock was significantly different before and after the release of Supersize me! But check this out…

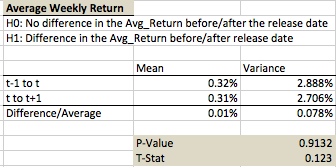

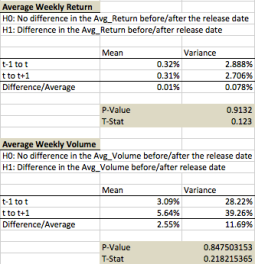

Over the same time period, but at a weekly tenor, we see a different result. This p-value is huge, the average weekly returns were not significantly different from one another before and after the release of Supersize me.

This exercise goes to show you should be wary and inquisitive if a statistic doesn’t make sense or makes too much sense. The financial world is not a laboratory where everything works out the way it “should” according to the models. Statistical findings are useful tools to model and describe our world, but always take them with a grain of sand. (I’m never sure if its sand or salt…)

Challenge ideas, be inquisitive, and don’t get all your news in one place.

Thanks for reading,

-tommander-in-chief

Note 1: If you want the data, I’ll be happy to provide it.

Note 2: Time Period (Jan. 1, 2004 – Sept. 20, 2004)

Side note: Risk is a human made concept. If you can associate a probability with an uncertainty, you’ve created risk. If you can’t calculate a probability that an event will occur it remains an uncertainty, and is either over or underestimated depending on your past experiences. For example: you hear about a recent shark attack on the news and are planning a day at the beach. Because of immediately available information, you overestimate the probability that you’ll be attacked by the shark and spend the day building sandcastles rather than shredding the surf. The risks don’t match up.Your perceived risk and the probability that you’ll be gobbled up by a Great White are different.

Leave a comment